Portugal Luxembourg Double Tax Treaty

Signed at The Hague on 8 May 1968 Authentic texts. 1 January 2020 All other taxes.

International Taxation And Luxembourg S Economy In Imf Working Papers Volume 2020 Issue 264 2020

1 tax information exchange agreements TIEAs and protocols.

Portugal luxembourg double tax treaty. Protocol amending the agreement between the State of Malta and the Kingdom of Belgium for the avoidance of double taxation and the prevention of fiscal evasionand the protocol signed at Brussels on 28 June 1974 as amended by the supplementary agreement signed at Bruseels on 23 June 1993 - signed on 19 January 2010 - LN 274 of 2013. Latest news on the Luxembourg double tax treaties. This includes negotiating and bringing into force New Zealands.

The Luxembourg tax authorities published synthesized texts of the MLI-affected treaties. Creatrust Corporate Double Tax Treaties Luxembourg Double Tax Treaty - Portugal. Double tax agreements DTAs and protocols.

Comprehensive Double Taxation Agreements concluded. Convention between the Grand Duchy of Luxembourg and the Portuguese Republic for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and on capital. New tax treaty with Serbie is in force as of December 2016.

Spain - Portugal Income Tax Treaty 1993 Art. Tax treaties by country. Ireland introduced the Universal Social Charge USC a new tax imposed on total income with effect from 1 January 2011.

_List of double tax treaties in force and in negotiation as of 28 July 2021. Below we break down the timing application in Luxembourg of certain key MLI-affected treaties. See list of French tax treaties.

Information on all the tax treaties signed by Luxembourg. Not subject to WHT in the case of holdings of at least 10 owned for at least one year. New Tax treaty with Senegal was signed on 10 February.

See general information about Spanish taxes. Luxembourg Poland June 26 2012. Directly or directly and indirectly holds at least 10 of the share capital or of voting rights in the Portuguese subsidiary 25 in the.

Convention for the avoidance of double taxation and the pre vention of fiscal evasion with respect to taxes on income and fortune with protocol. Double Tax Treaties Tax Treaty Agreements. Portugal Luxembourg Double Tax Treaty Landwell Luxembourg Portugal April 27 2011 On February 24 2011 the Portuguese Council of Ministers approved the proposal of.

France - Italy Income and Capital Tax Treaty 1989 Art. The agreements cover direct taxes which in the case of Ireland are. The 81 double tax avoidance.

New Tax treaty with Brunei is in force as of December 2016. Luxembourg Parliament voted to approve Bill n7390. 73 are in effect.

Its major role in terms of international trade in the sectors of banking and finance investment funds and holding companies has. Double tax treaties can be complex and often will require professional assistance but they are created to try to ensure that an individual is able to claim tax relief rather than have to pay tax on the same income in two different jurisdictions. Information on all the tax treaties signed by Luxembourg.

Treaties approved by the Brazilian government to be in force as of January2022 In the case of the United States United Kingdom and Germany the Brazilian authorities have already officially recognised the reciprocity of tax treatment which permits the offsetting of the tax paid in those countries against the tax due in Brazil on the same earnings. Ireland has signed comprehensive Double Taxation Agreements DTAs with 74 countries. For the purpose of this article we.

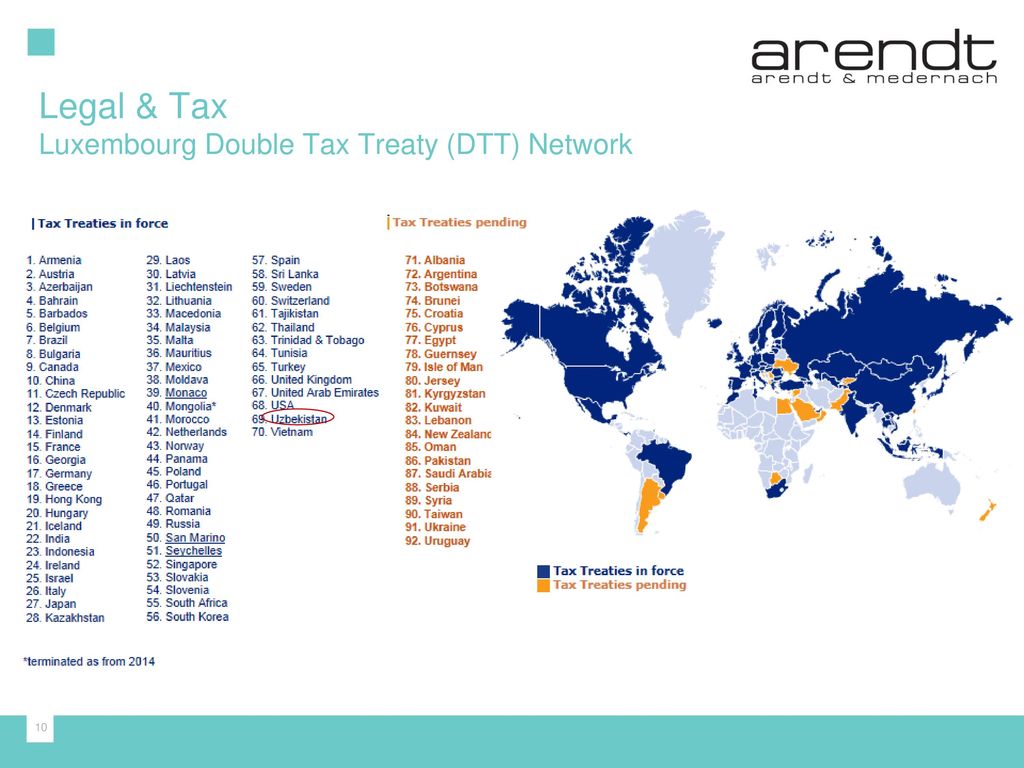

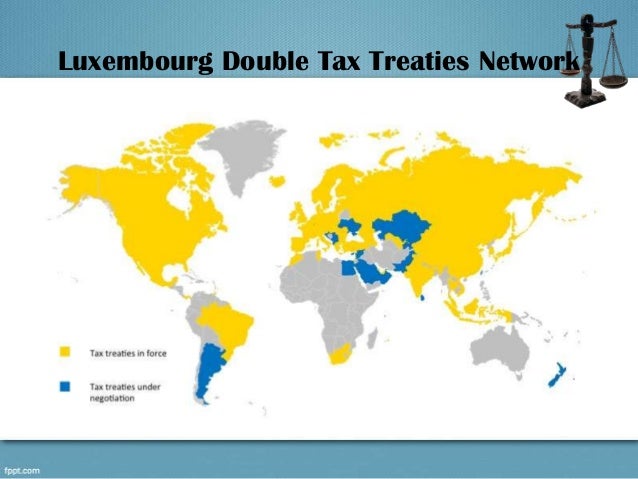

Insights Industries Services Careers About us Please note that your account has not been verified - unverified account will be deleted 48 hours after initial registration. So far Luxembourg has concluded 117 tax treaties and is party to a series of. This Convention shall apply to persons who are residents of one or both of the.

See more information about Portuguese. New Tax treaty with Tunisia is in force as of December 2016. New tax treaty with Uruguay is in force as of December 2016.

Situated at the crossroad of Europe the Grand-Duchy of Luxembourg is based on a dynamic and open economy which actively promotes the development of cross border trade and investments. Click anywhere on the bar to resend verification email. Country Name Treaties signed but not in force.

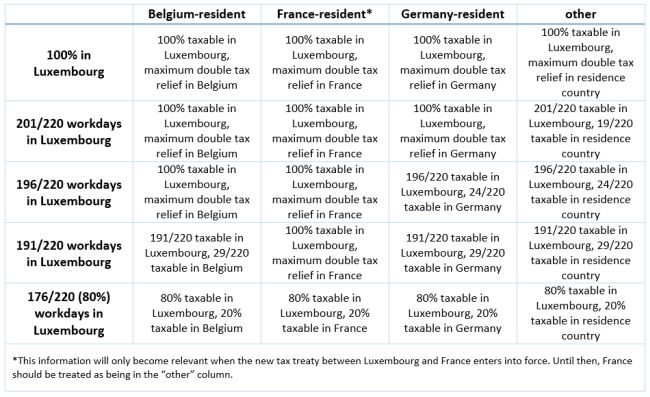

Different types of taxes mean different timing of application. As a rule the method. Share with your friends.

On 7 June 2012 Luxembourg and Poland signed a Protocol amending the Double Tax Treaty concluded between the two countries on. Signing a double tax treaty implies that the Contracting states decide which one of them will levy a certain tax. Each double tax treaty is different although many follow very similar guidelines - even if the details differ.

France - Germany Income and Capital Tax Treaty 1959 Art. Over the years Portugal has signed fifty-two double tax treaties for the avoidance of double taxation on income tax following the OECD Model Convention with some reservations which are aimed essentially at ensuring a broader concept of permanent establishment and seek to raise the level of taxation in the source country with regard to dividends interest and royalties. We advise the Government on international tax issues and are involved with the development and implementation of New Zealands international tax legislation.

See list of French tax treaties. The following is a summary of the work underway to negotiate new DTAs. The model used for double tax treaties in Luxembourg is in line with the provisions of the Organization of Economic Cooperation and Development OECD and the most important goal of the treaties is to eliminate double taxation for the same legal entity or for the same individual.

For non-residents tax withheld is the final tax except for property income in which case it is a payment on account. Double Taxation Treaties Overview. PAYS-BAS et LUXEMBOURG Convention tendant à éviter les doubles impositions et à pré venir lévasion fiscale en matière d.

Implementing a new double Tax treaty - signed on 20 March 2018 - with France replacing the previous treaty that was signed on 1 April 1958 Implementing a double Tax treaty - signed on 8 December 2017 - with Kosovo for the elimination of double taxation with respect to taxes on income and on capital and the prevention of tax evasion and. Registered by the Netherlands on 1 December 1969. As of March 2021 Luxembourg has signed 88 double tax treaties as.

Pursuant to paragraph 4 of Article 2 the Agreement shall also apply to the USC. 44 rows Treaty Provisions. Taxable period starting as from 1 April 2020.

Consequences Of The Termination Of The Double Tax Treaty Between The Netherlands And Russia

Double Tax Treaties In Portugal We Assist Foreign Investors

Luxembourg Uzbekistan Business Relations A Focus On Financial Services Ppt Download

The Luxembourg Treaty Network Luxembourg Tax Challenges For

European Tax Treaties Tax Treaty Network Of European Countries

Double Tax Treaties In Luxembourg

Multilateral Convention To Implement Tax Treaty Related Measures To Prevent Beps Oecd

Double Tax Treaties Experts For Expats

Treaties For The Avoidance Of Double Taxation Concluded By Member States

The Double Taxation Treaty Between Andorra And Portugal Enters Into Force In April Andorra Business

Guiding You Through Portugal S Non Habitual Residence Tax Nhr Mygrate Investments

International Taxation And Luxembourg S Economy In Imf Working Papers Volume 2020 Issue 264 2020

Tax And Social Security For Cross Border Commuters Home Workers Employment And Hr Luxembourg

Why Luxembourg Reasons For Setting Up In The Grand Duchy

The Protocol To The Russia Luxembourg Double Tax Treaty Has Been Signed

What Is The Uk Portugal Double Taxation Treaty And How Does It Affect Business Owners Rhj Accountants Associates